Hello,

I am currently using a MacOS System, PyCharm, and the Thomson Reuters API Proxy.

I am having some issues retrieving the following data for options on the S&P500 Index over different maturities and moneynesses.

- Price Call

- Price Put

- Implied Volality (or better, Implied Variance)

- Time To Maturity

- Strike

- Current Stock Price

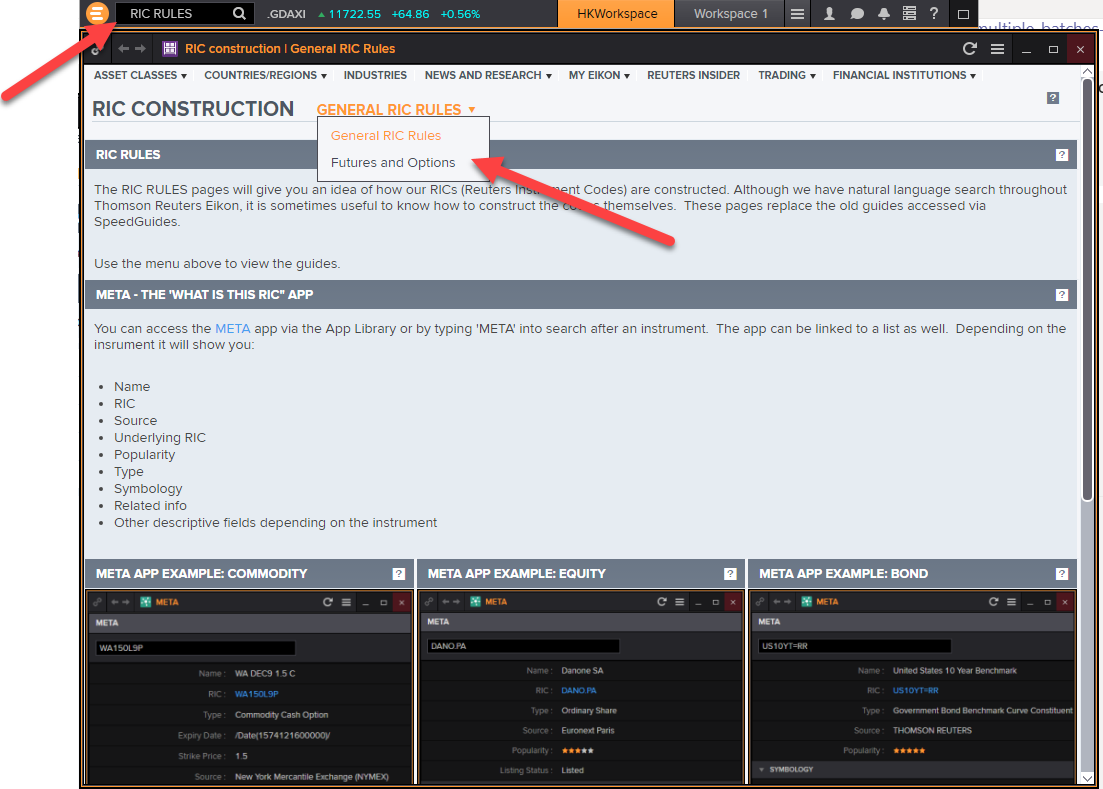

Before posting here, I tried to solve the issue on my own, attempting to e.g. this video:

As, mentioned I am interested in the S&P500 Index options, I further would like to know how one can retrieve the above listed data. I looked into the Data Item Browser and did not find exact matches to the DAX example.

Question 1: How can I find this information?

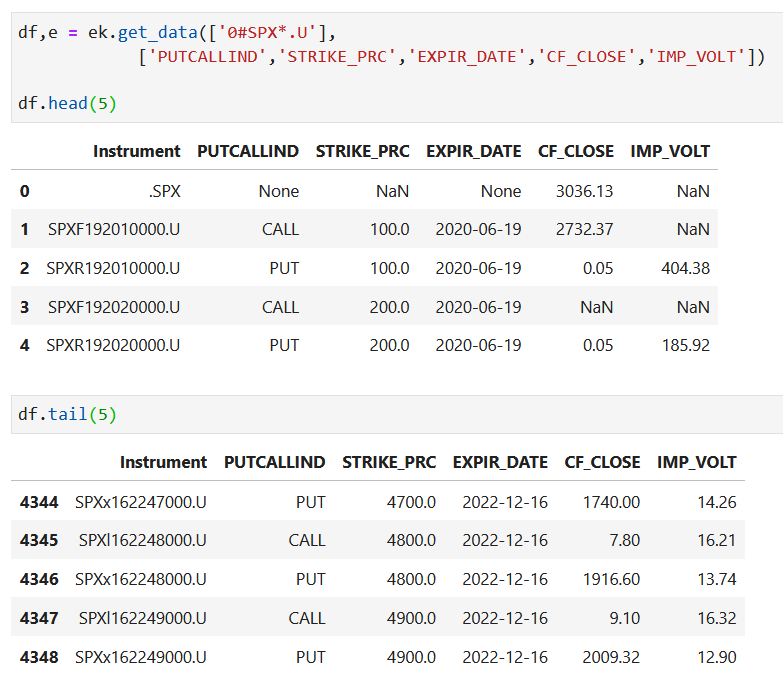

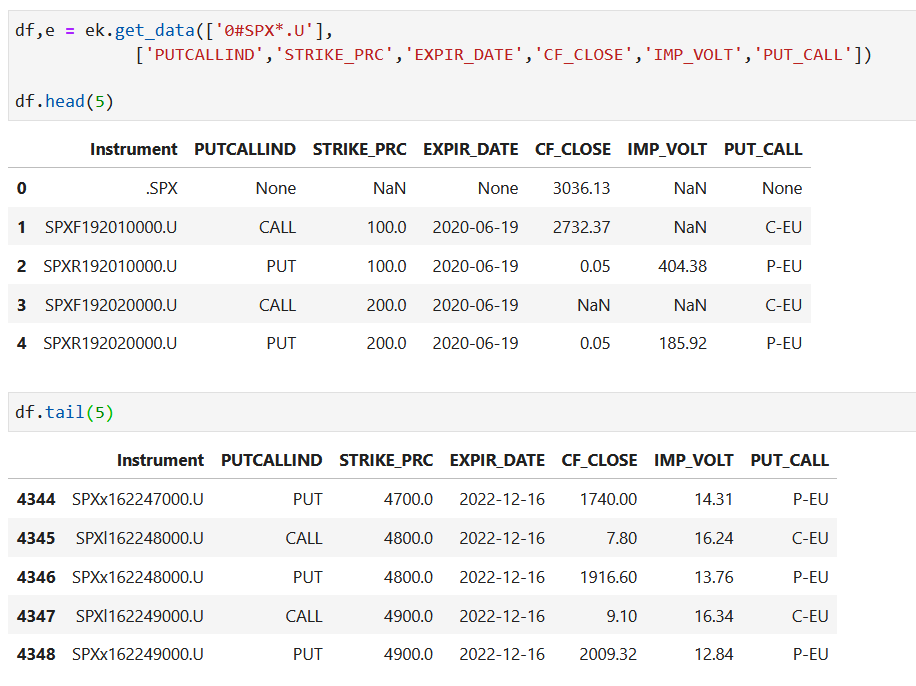

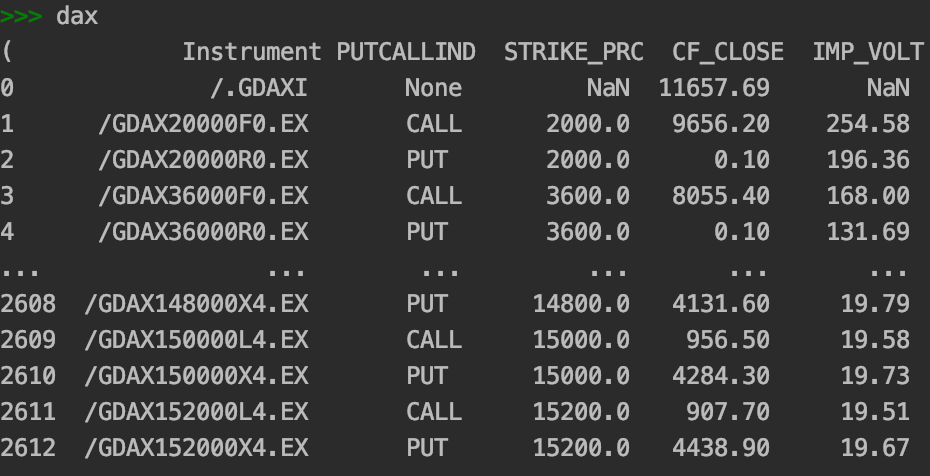

The below command gives me the result of my screenshot of replicating the DAX example from the video.

dax = ek.get_data('0#GDAX*.EX', fields = ['PUTCALLIND', 'STRIKE_PRC', 'CF_CLOSE', 'IMP_VOLT'])[0]

For Example in row 2611: What I can see is that the string is:

For Example in row 2611: What I can see is that the string is:

- unknown, starting with a "/"

- the instrument "GDAX",

- then the strike price 15200 with one additional decimal "152000"

- unknown, possibly referring to maturity (?) "L4"

- unknown, ".EX"

Question 2: What exactly is the meaning of the values inside of the 'Instrument' column? Especially, what is the meaning of the for me unknown parts of the string? How can I map this?

Thanks a lot and best regards!