Hi,

I'm trying to pull the Option Adjusted Spread (FiOptionAdjustedSpread) for a specific bond on a specific date. Can anyone help me with the python code for that? Thank you!

For a deeper look into our Eikon Data API, look into:

Overview | Quickstart | Documentation | Downloads | Tutorials | Articles

Hi,

I'm trying to pull the Option Adjusted Spread (FiOptionAdjustedSpread) for a specific bond on a specific date. Can anyone help me with the python code for that? Thank you!

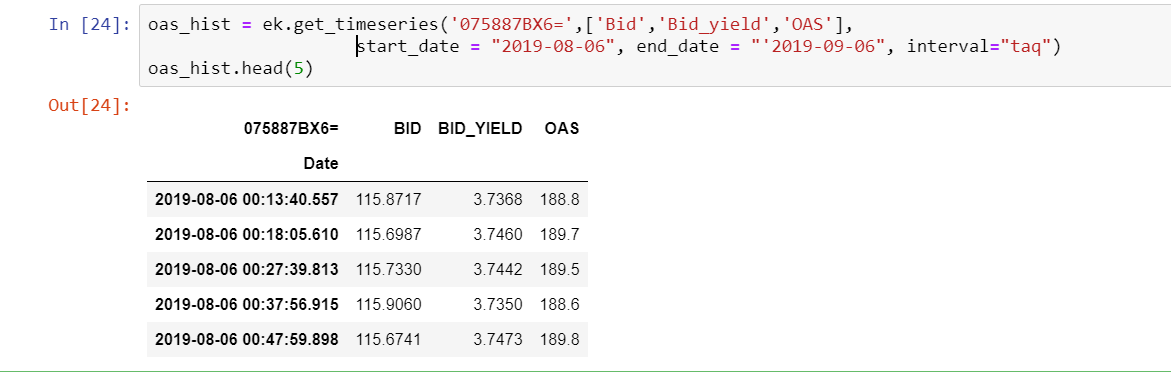

If you want to reference OAS via the get_timeseries() function you would reference "OAS" as the field (which is pulling from TR.OPTIONADJUSTEDSPREADBID) ; there are some slight differences required at times when using get_data() vs. get_timeseries() to pull hisotrical values since there are multiple databases for some data types.

oas_hist = ek.get_timeseries('075887BX6=',['Bid','Bid_yield','OAS'], start_date = "2019-08-06", end_date = "'2019-09-06", interval="taq")

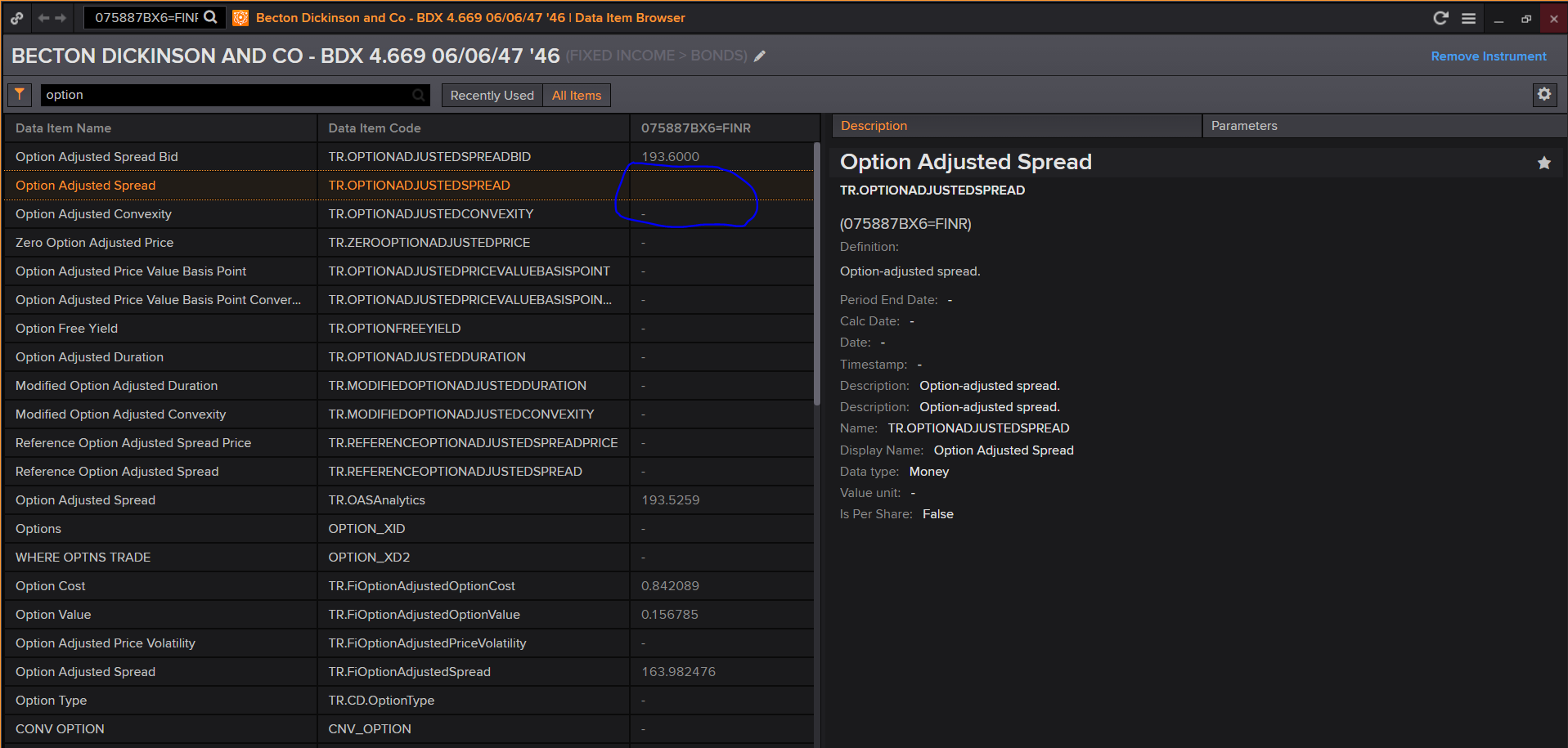

The field TR.OPTIONADJUSTEDSPREAD does not appear to have a value available for 075887BX6=FINR . I recommend using TR.OPTIONADJUSTEDSPREADBID or TR.OASAnalytics;

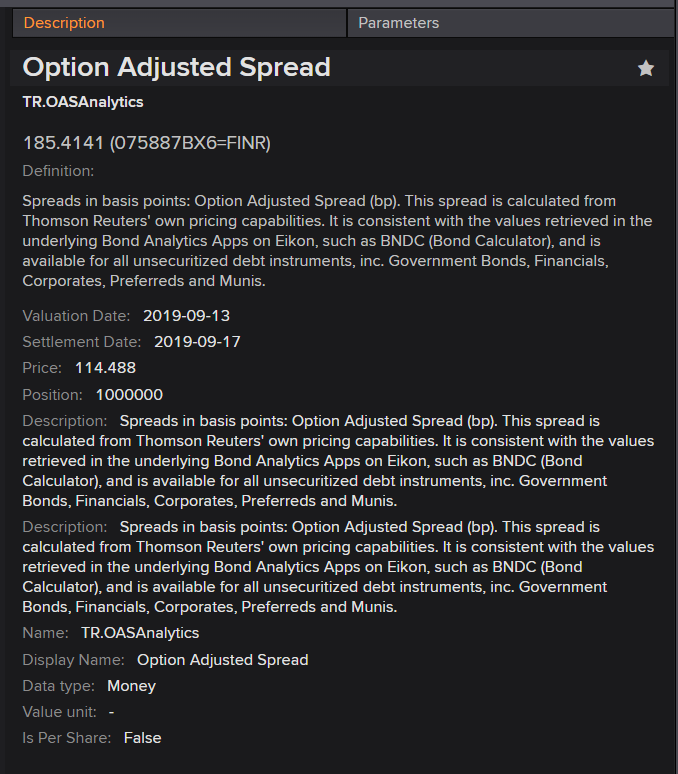

ek.get_data('075887BX6=FINR','TR.OASAnalytics(ValuationDate=20190719)')

Thanks for your answer. I am trying to pull FiOptionAdjustedSpread specifically since I need the spread based on the Treasury rates. I don't know how normal OptionAdjustedSpread function or OASAnalytics function are calculated but those values are different from what I'm looking for... is there a way to pull FiOptionAdjustedSpread? if not for this bond, other bonds?

Tkanks Nate; to be honest TR.OPTIONADJUSTEDSPREAD is a legacy analytics field. TR.OASAnalytics is a more modern analytic field and there are more details provided on methodology (see below). If you need/want more details on calc methodology feel free to email me at james.perkins@refinitiv.com .