Hi, I wish to get credit ratings data from Refinitiv. I am aware of RATMON, GOVSRCH, and FINIM inside Eikon, but how can I extract all of them by applying my own filter via the API?

- Home

- Anonymous

- Sign in

- Create

- Post an idea

- Create an article

- Spaces

- Alpha

- App Studio

- Block Chain

- Bot Platform

- Connected Risk APIs

- DSS

- Data Fusion

- Data Model Discovery

- Datastream

- Eikon COM

- Eikon Data APIs

- Electronic Trading

- Elektron

- Intelligent Tagging

- Legal One

- Messenger Bot

- Messenger Side by Side

- ONESOURCE

- Open Calais

- Open PermID

- Org ID

- PAM

- ProView

- ProView Internal

- Product Insight

- Project Tracking

- RDMS

- Refinitiv Data Platform

- Rose's Space

- Screening

- Side by Side Integration API

- TR Knowledge Graph

- TREP APIs

- TREP Infrastructure

- TRKD

- TRTH

- Thomson One Smart

- Transactions

- Velocity Analytics

- Wealth Management Web Services

- Workspace SDK

- World-Check Data File

- 中文论坛

- Explore

- Tags

- Questions

- Ideas

- Articles

- Users

- Badges

For a deeper look into our Eikon Data API, look into:

Overview | Quickstart | Documentation | Downloads | Tutorials | Articles

question

Obtaining RATMON data

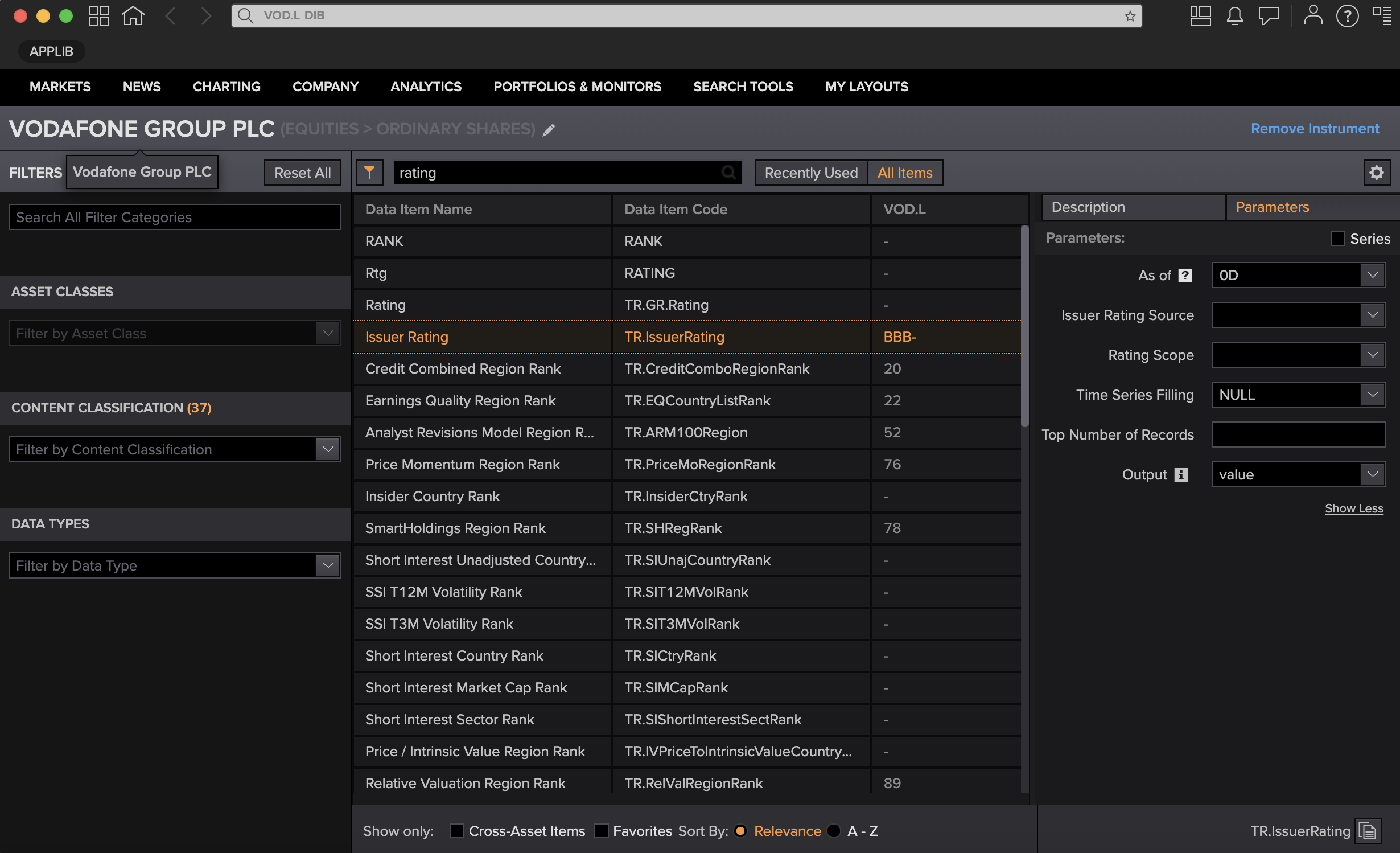

@qiujunda92 You might want to give a bit more detail about your use case so we can help you - but in terms of just extracting the data you can use the Data Item Browser App (type DIB into Eikon search bar). From there you can see what fields are available for any instrument bonds or equities. In terms of Ratings you can see the field 'TR.IssuerRating' and as you can see in the parameters section you can select the source of the rating if you wish and indeed get a timeseries of the rating if you require.

So if you use the article I sent you you can see that you need to use the ek.get_data() function in the Eikon Data API to extract the data. Once you have the data for the universe or list of instruments you need in a dataframe for example - you can then do any filtration operations in python.

If you are looking to build a universe of instruments based on some criteria eg issuers in the semiconductor sector you can use the Screener App to help you build the appropriate list of instruments. We have an excellent article here to help you with that.

I'm not sure we can be of any more help unless you are able to be more specific. But I hope this information can be of use.

Hi @qiujunda92 Please see the following excellent tutorial on creating a credit rating transition matrix I hope this can help you.

Hi @jason.ramchandani, unfortunately, this tutorial requires you to know the instruments before hand, or they belong to a index which constituents we know. This does not apply in my case, so directly obtaining the 3 screens RATMON, GOVSRCH and FINIM would be better.

Hi, considering the above tutorial would not be suitable for my case, are there any guides or suggestions I can try?