Currently for my master's thesis, I'm doing research on M&A.

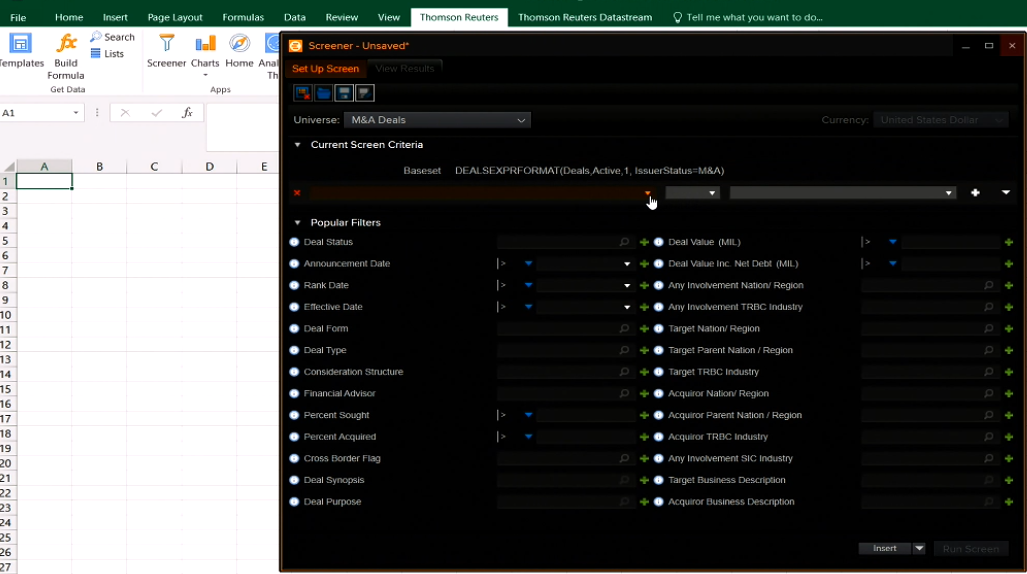

I have collected about 700+ acquisitions & mergers over the past years through using the Deal Screener in the Thomson Reuters tab on Excel. All I need to do now is get the Market cap and other financials from the companies that I have found who did an M&A.

I know that you can easily get financials for these companies using the RIC or an ISIN number. However, while using the deal screener, it does not offer me an option to return any identification number which can be used to request financials such as the stock Price, EBIT, ...

How can I request a RIC or ISIN number (or sortalike number) using the deal screener? I have looked everywhere on the internet but can't seem to find anything. Or is there another identification code that I can use or request somewhere by using the deal screener?

I also have the names, CUSIP number, ticker symbols of the companies, but I can't be asked to enter them manually & look up the financials one by one... This would take ages. Also by selecting the range of all these names, cusip, tickers, it just returns me errors.I'd be forever grateful if someone could help me out here.

Kind regards