Based on answers from customer service, I confirmed that PTS is either added or subtracted from Spot rate.

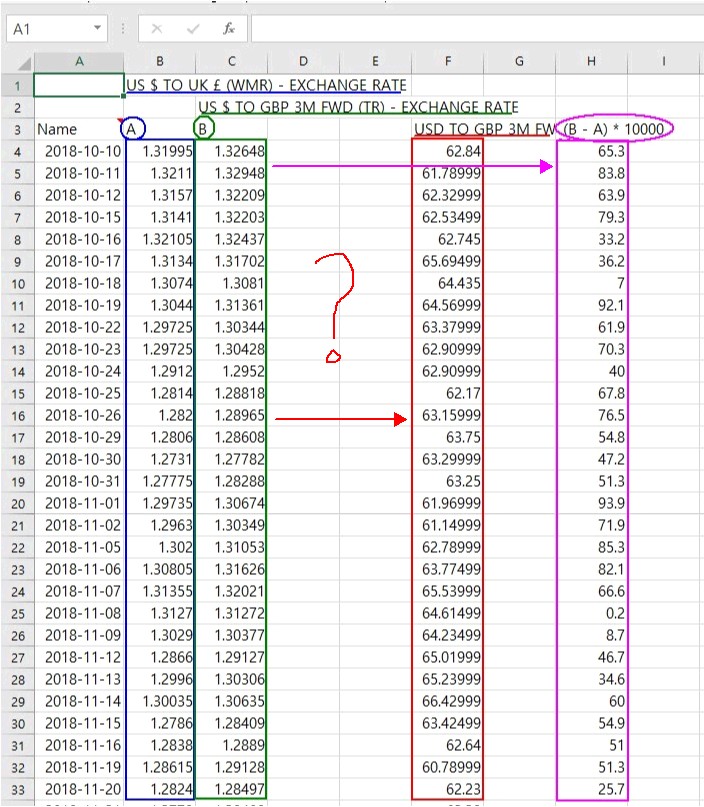

But, when I used "USD to GBP Exchange Rate" (Blue Column)/ "USD to GBP 3Month Forward Exhange Rate" (Green Column) to calculate PTS (Pink Column), as you can see the result is different from the real PTS (Red Column).

So, how can I actually use the real data in the two columns in blue and green to get the data in red column?

Ref)

The terms (TR) in the Datastream mnemonics TDEUR3M is an abbreviation for Thomson Reuters denoting the source of the series.

With regards the term PTS in connection with the series EUR3MFP, this is short for the term Forward Points.

Forward points are the number of basis points added to or subtracted from the current spot rate of a currency to determine the forward rate for delivery on a specific value date.

When points are added to the spot rate, this is called a forward premium; when points are subtracted from the spot rate, the currency trades at a forward discount.

The spot exchange rate is adjusted based on the difference between the interest rates of the two currencies and the time until the maturity of the deal, which yields the forward rate. Thus the spot foreign exchange quote is adjusted by applying, for example, the three month forward points to it, to calculate the full three month forward foreign exchange quote.

Example: If the spot foreign exchange quote is: GBP 1 = 1.6000 - 1.6010 USD And if one-month forward points are 5-8 (rising): Then the one-month forward exchange quote is calculated by adding the forward points as follows: 1.6000 + 0.0005 = 1.6005 USD 1.6010 + 0.0008 = 1.6018 USD

The full forward quote (bid-offer) is: GBP 1 = 1.6005 - 1.6018 USD.

Regards,

Zac

Refinitiv Customer Support