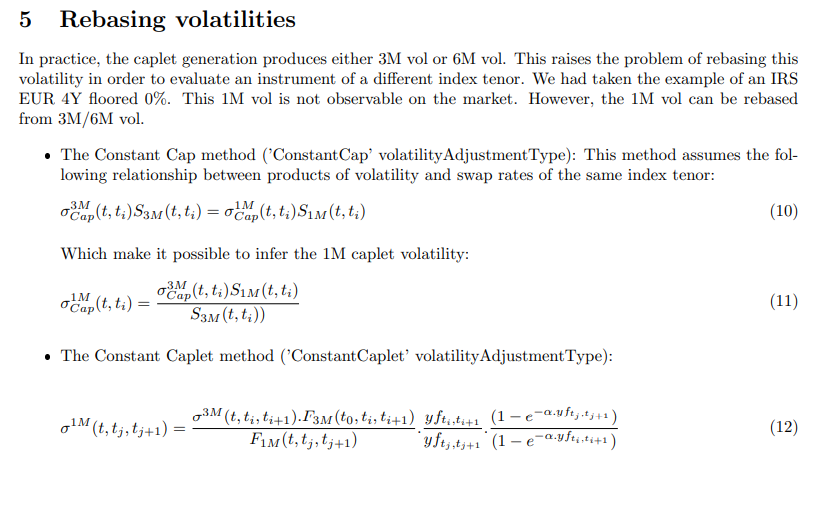

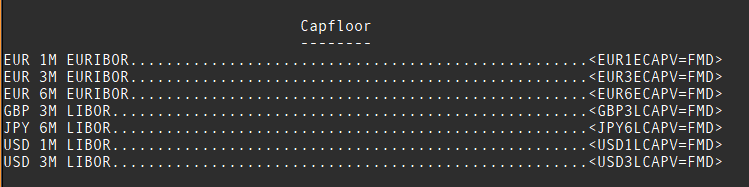

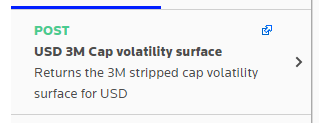

Hi, I am using the API playground to retrieve the EUR Cap volatility surface, but I have a question regarding the response data. In the description of the API endpoint I see the following sentence:

It points out that the stripped volatility surface is returned, but what I want is the flat volatility surface. In the response I can see two diferent volatilities surfaces but I do not know which is each one. The first one is in response["data"]["surface"] and the other one in response["data"]["calibrationParameters"].

Thanks in advance.