Can you advise how program in python the time series of the percentage of stocks in an index? Let's say the S&P 500, which their end of day prices are above or below their 50 (100 or 200) days moving average.

- Home

- Anonymous

- Sign in

- Create

- Post an idea

- Create an article

- Spaces

- Alpha

- App Studio

- Block Chain

- Bot Platform

- Connected Risk APIs

- DSS

- Data Fusion

- Data Model Discovery

- Datastream

- Eikon COM

- Eikon Data APIs

- Electronic Trading

- Elektron

- Intelligent Tagging

- Legal One

- Messenger Bot

- Messenger Side by Side

- ONESOURCE

- Open Calais

- Open PermID

- Org ID

- PAM

- ProView

- ProView Internal

- Product Insight

- Project Tracking

- RDMS

- Refinitiv Data Platform

- Rose's Space

- Screening

- Side by Side Integration API

- TR Knowledge Graph

- TREP APIs

- TREP Infrastructure

- TRKD

- TRTH

- Thomson One Smart

- Transactions

- Velocity Analytics

- Wealth Management Web Services

- Workspace SDK

- World-Check Data File

- 中文论坛

- Explore

- Tags

- Questions

- Ideas

- Articles

- Users

- Badges

For a deeper look into our Eikon Data API, look into:

Overview | Quickstart | Documentation | Downloads | Tutorials | Articles

question

How to program in python the time series of the percentage of stocks in an index

1 Answer

It is better to contact the Eikon Excel support team to verify how to do it in Eikon Excel with the =TR function.

Then, we can convert the formula used in Eikon Excel to Python code.

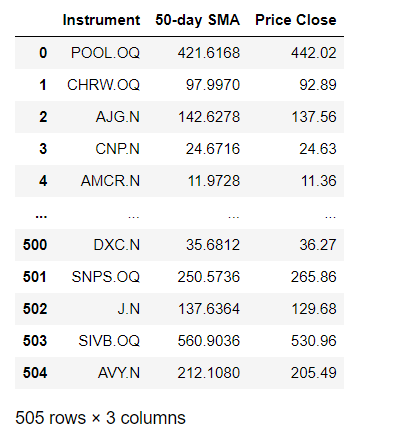

For example, "Let's say the S&P 500, which their end of day prices are above or below their 50 (100 or 200)". We can use the following code to get 50-Day SMA.

df, err = ek.get_data("0#.SPX",["TR.Price50DayAverage","TR.PriceClose"])

df

Then, we can calculate the percentage of stocks that have end-of-day prices above 50-day SMA.

(len(df[df["Price Close"] > df["50-day SMA"]])/len(df))*100

The output is 30.89%.

In conclusion, please directly the Eikon Excel support team via MyRefinitv (https://my.refinitiv.com/content/mytr/en/helpandsupport.html) to verify how to do it in Eikon Excel. Then, we can convert the Excel formula to the Python code that uses Eikon Data API to retrieve the data.