This seems to be possible using the RHistory function in Excel, but not using one of the Eikon APIs in Python. The get_timeseries does not provide discount factors.

- Home

- Anonymous

- Sign in

- Create

- Post an idea

- Create an article

- Spaces

- Alpha

- App Studio

- Block Chain

- Bot Platform

- Connected Risk APIs

- DSS

- Data Fusion

- Data Model Discovery

- Datastream

- Eikon COM

- Eikon Data APIs

- Electronic Trading

- Elektron

- Intelligent Tagging

- Legal One

- Messenger Bot

- Messenger Side by Side

- ONESOURCE

- Open Calais

- Open PermID

- Org ID

- PAM

- ProView

- ProView Internal

- Product Insight

- Project Tracking

- RDMS

- Refinitiv Data Platform

- Rose's Space

- Screening

- Side by Side Integration API

- TR Knowledge Graph

- TREP APIs

- TREP Infrastructure

- TRKD

- TRTH

- Thomson One Smart

- Transactions

- Velocity Analytics

- Wealth Management Web Services

- Workspace SDK

- World-Check Data File

- 中文论坛

- Explore

- Tags

- Questions

- Ideas

- Articles

- Users

- Badges

For a deeper look into our Eikon Data API, look into:

Overview | Quickstart | Documentation | Downloads | Tutorials | Articles

question

Is it possible to retrieve government bond discount factors using Eikon APIs?

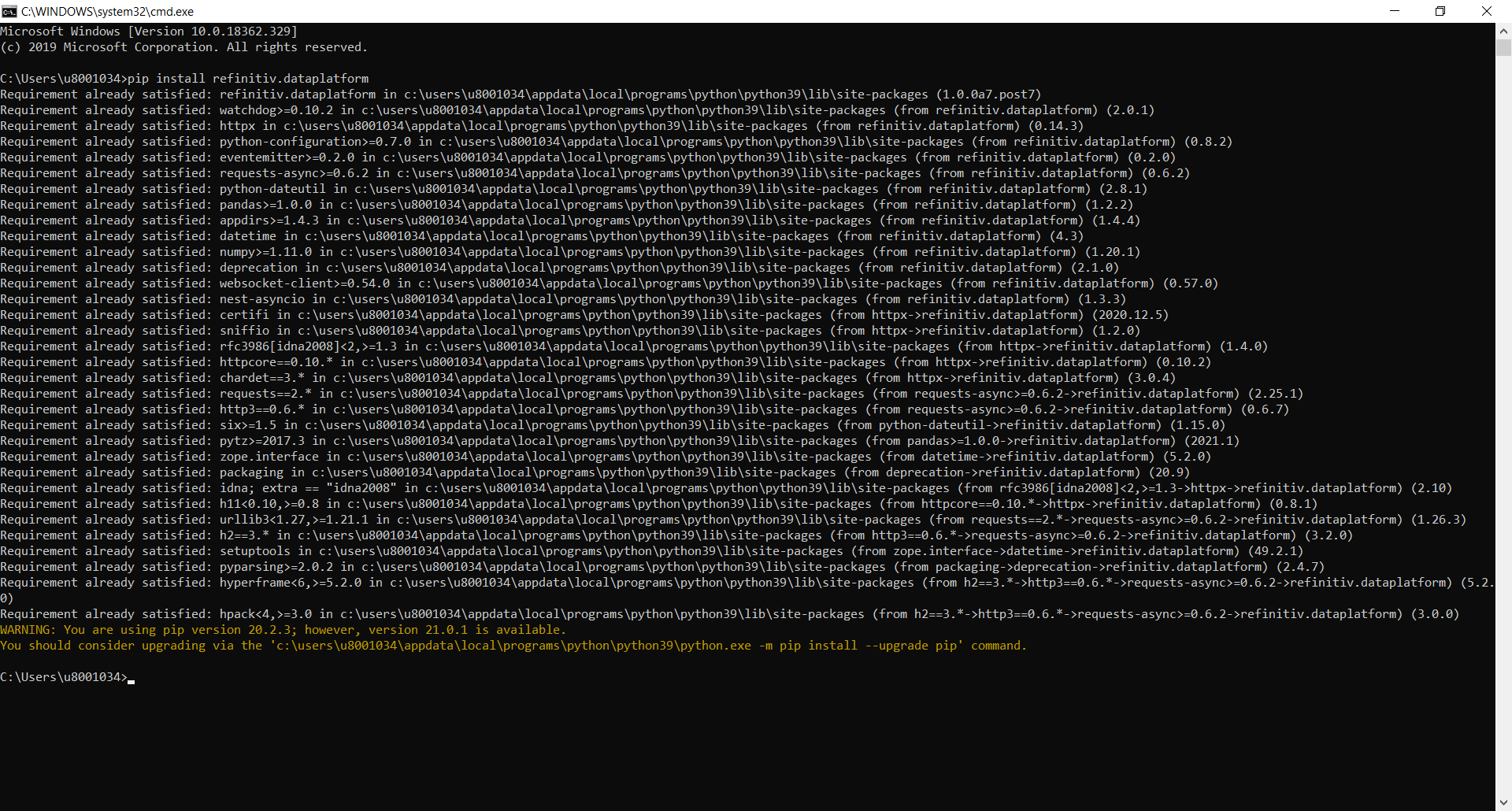

You can install RDP Library by using this command:

pip install refinitiv.dataplatform

Then in your code, you can add this code, the RDP Library will connect to your Eikon Desktop(similar to Eikon Data API):

import refinitiv.dataplatform as rdp

rdp.open_desktop_session('<valid app key>')

df= rdp.get_historical_price_summaries('PLGOV1YZ=R', start='20210201', end='20210215')

display(df)

I should add to the answer by @chavalit.jintamalit that RDP Library for Python includes Eikon Data APIs as a module. Hence you can use both Eikon Data APIs and RDP Libraries methods from the same library. The following example uses Eikon Data APIs to retrieve the constituents of the Polish Treasuries zero curve, and then uses get_historical_price_summaries method of RDP Libraries to retrieve timeseries for the 1Y maturity point on the curve.

import refinitiv.dataplatform as rdp

import refinitiv.dataplatform.eikon as ek

rdp.open_desktop_session('MY_APP_KEY')

tmp_df, err = ek.get_data('0#PLXZ=R',['TENOR'])

df= rdp.get_historical_price_summaries(

tmp_df.loc[tmp_df['TENOR']=='1Y','Instrument'].iloc[0],

start = '20210201',

end = '20210215')

display(df)

I suppose what you would like to retrieve is timeseries of discount factors for various points on the zero curve derived from Treasuries, right? If this is the case, you can do this using RDP Libraries. Here's a the call using 10Y maturity point on US Treasuries zero curve.

rdp.get_historical_price_summaries('USGOV10YZ=R')

If you would like to retrieve something else, could you provide an example of RHistory function that retrieves the data you're interested in?

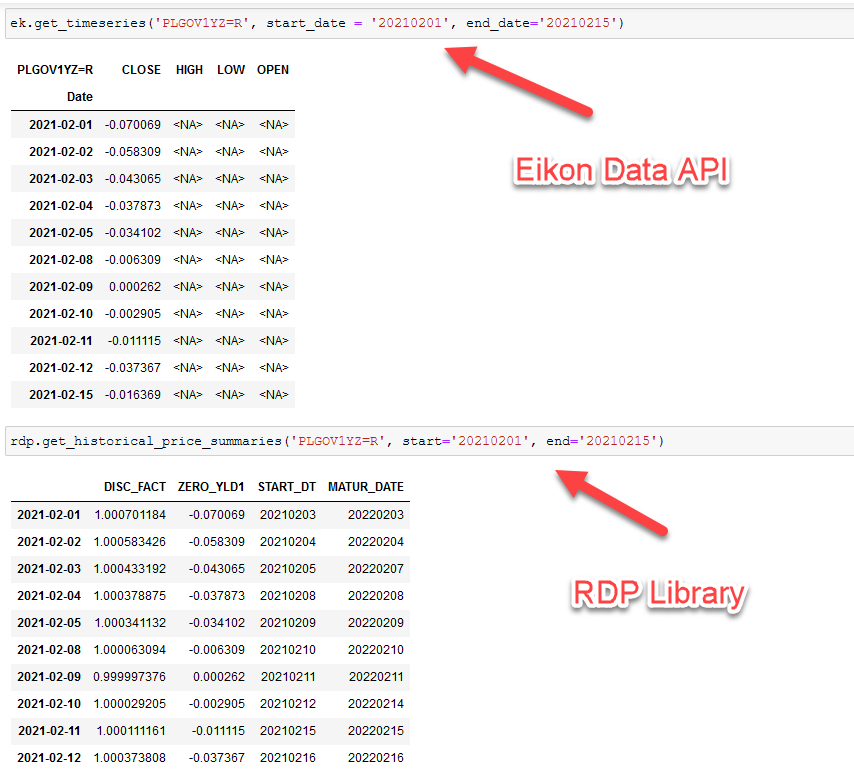

I have made a comparison in Excel for the 1Y Polish Government Bond rate (PLGOV1YZ=R). Retrieving both the discount factors and zero yields would result in the following:

Discount factor

Zero yield

When using the ek.get_timeseries() function in Python I am only able to retrieve the zero yields, which I can't transform to the discount factors (probably there is some smoothing involved). Are the discount factors available from the RDP library? What is the difference between the RDP.get_historical_price_summaries() function and the ek.get_timeseries() function?

The discount factor is available from the RDP Library.

The difference between EK vs RDP is:

- Eikon.get_timeseries can only retrieve "default" view data.

- RDP.get_historical_price_summaries can cover more views.