Hi,

Currently, we are seeing a fairly high percentage of bonds where 'bid price > ask price', and subsequently bid yield < ask yield in our data.

As this is unexpected and likely due to the way data is feeding in to our system, we are unable to determine how to resolve it (ex: in 2014 10% of the bonds had this issue, which is far more than expected.)

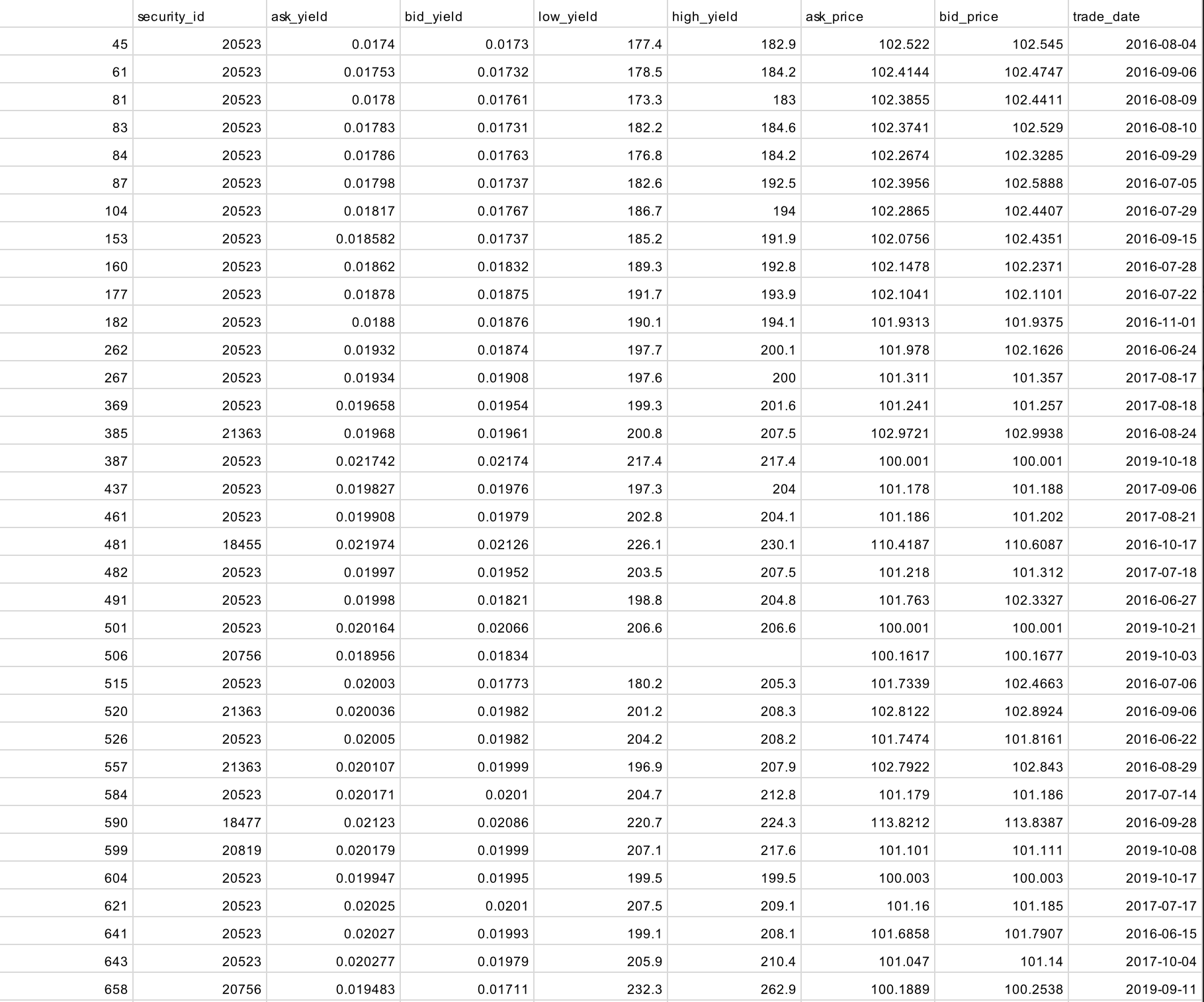

I've provided a sample of data we have where bid price > ask price for the company Goldman Sachs below.

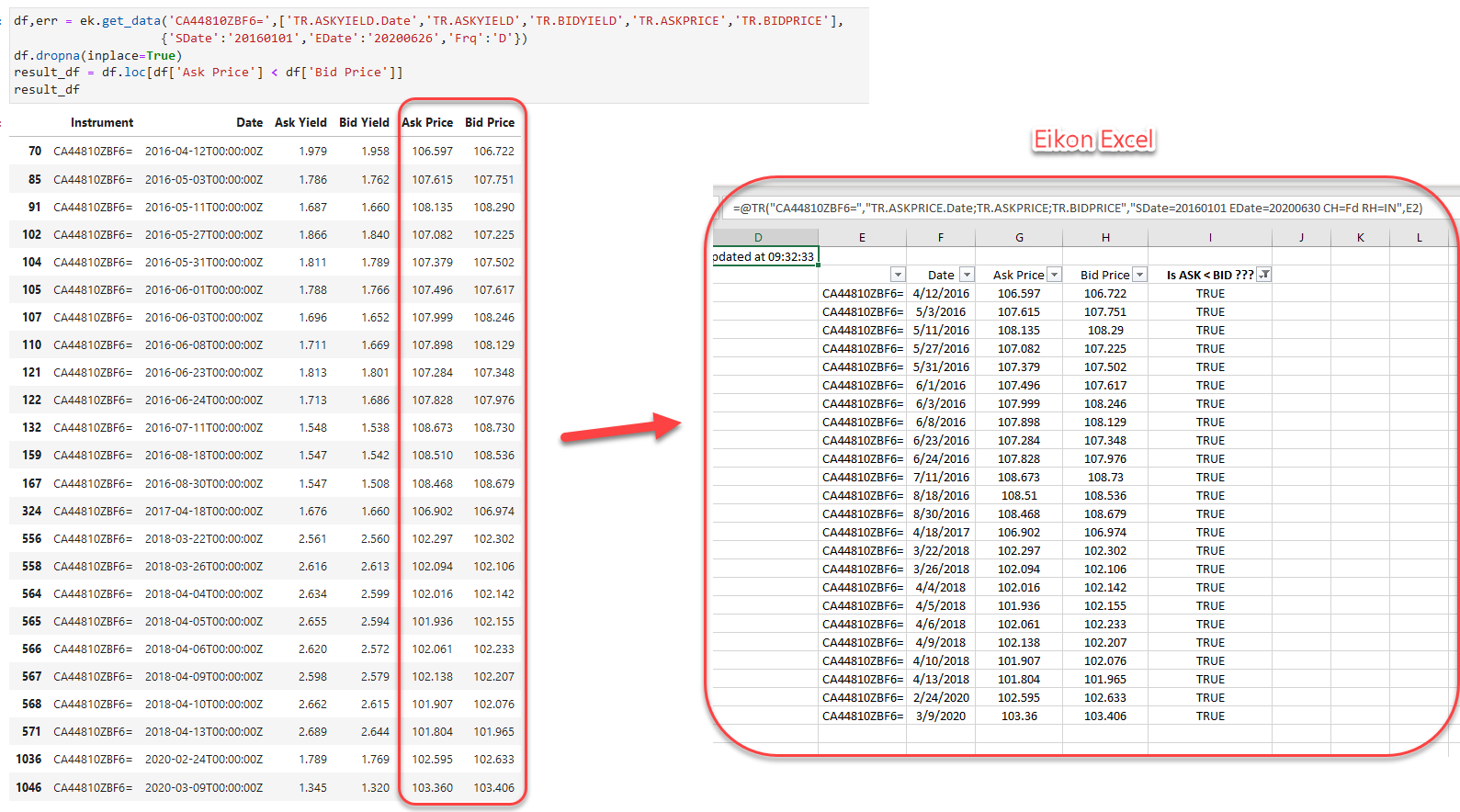

We are using the get_data function with the 'Frq' parameter set to 'D' for daily to get this data, and we are wondering why we might be noticing this issue with our data?

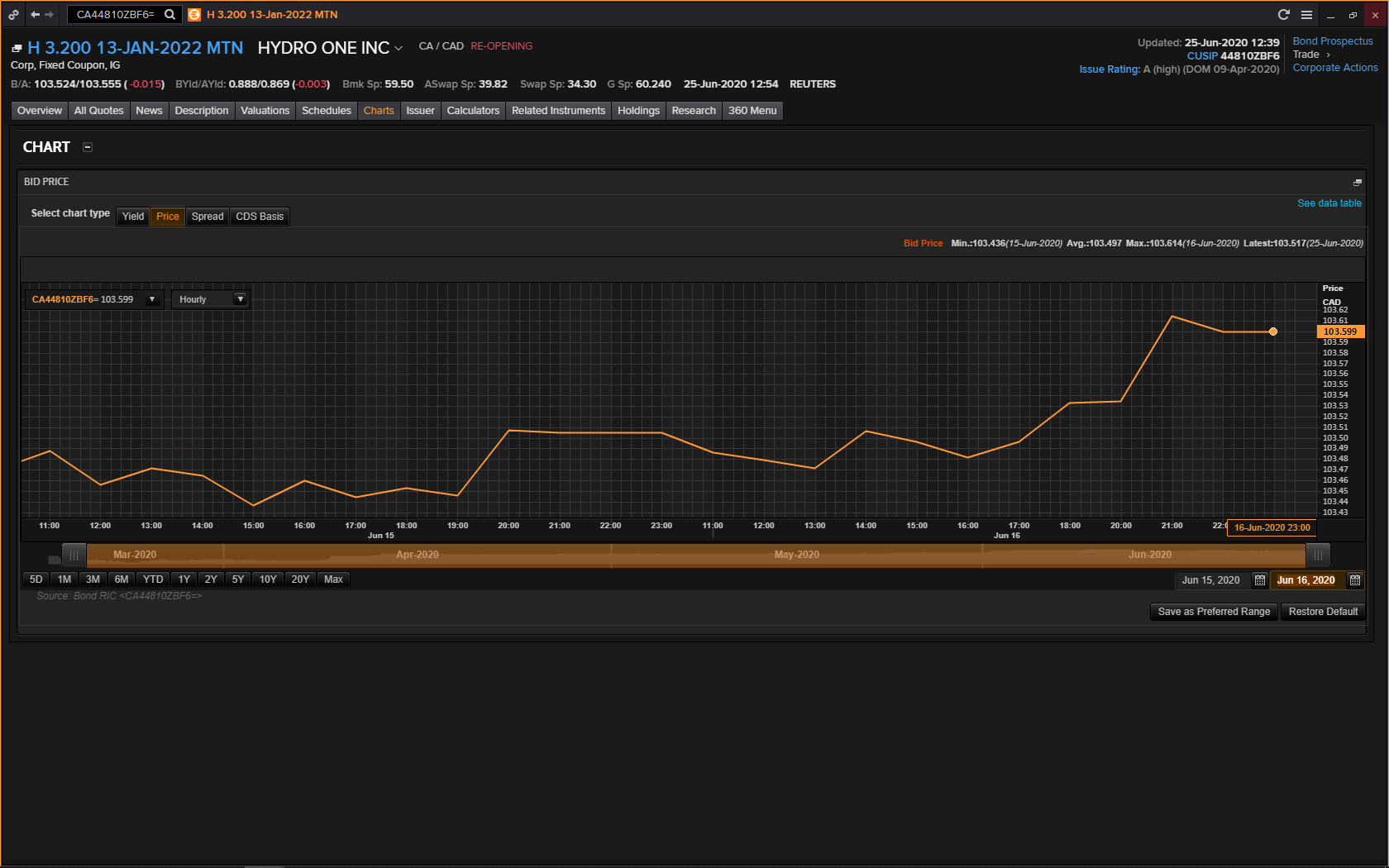

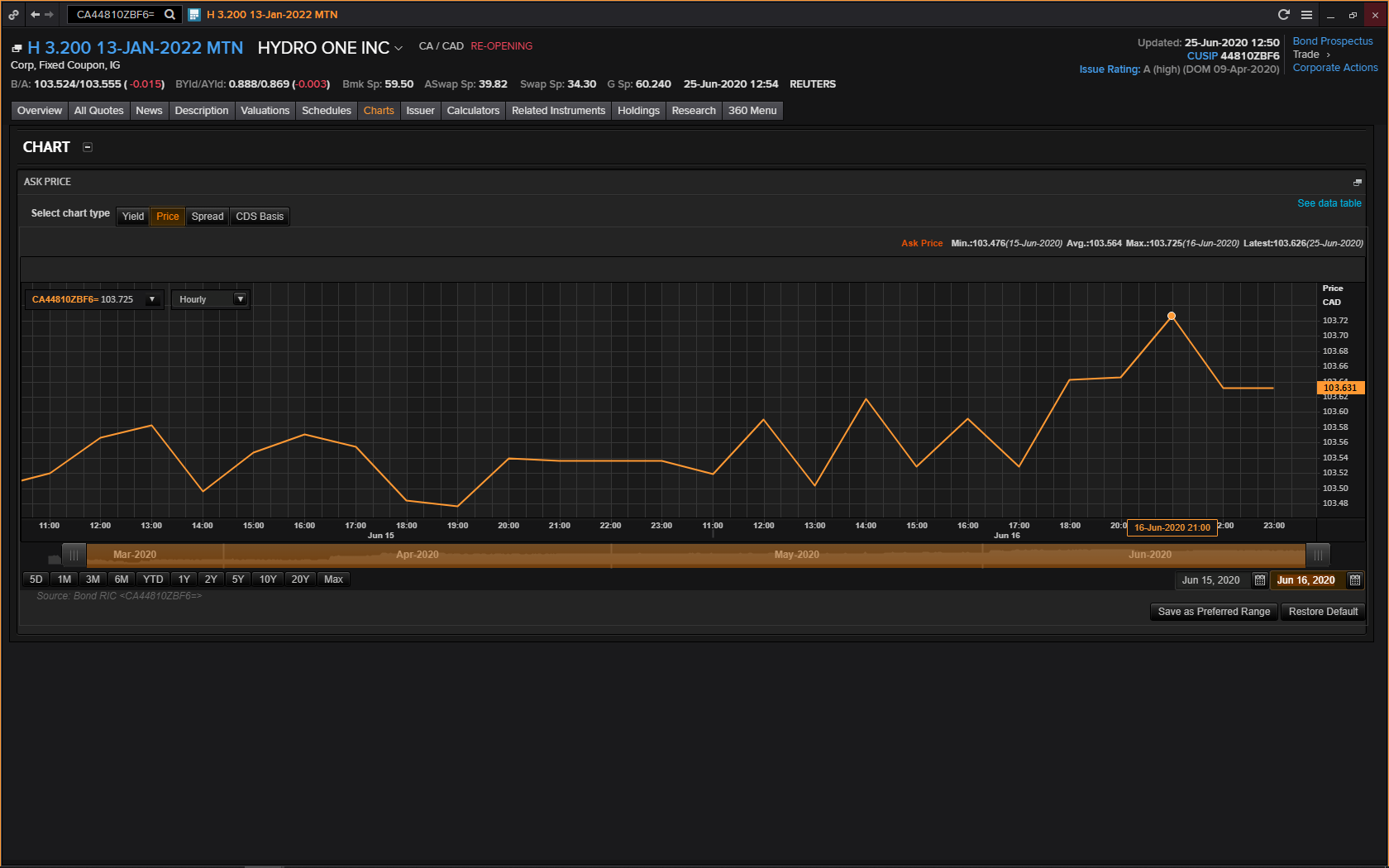

We suspect that it might be possible since we are getting daily data, it be that there is a mismatch and we are getting data from different hours (i.e. our ask price value may be from a different hour than bid price when we're getting this data)