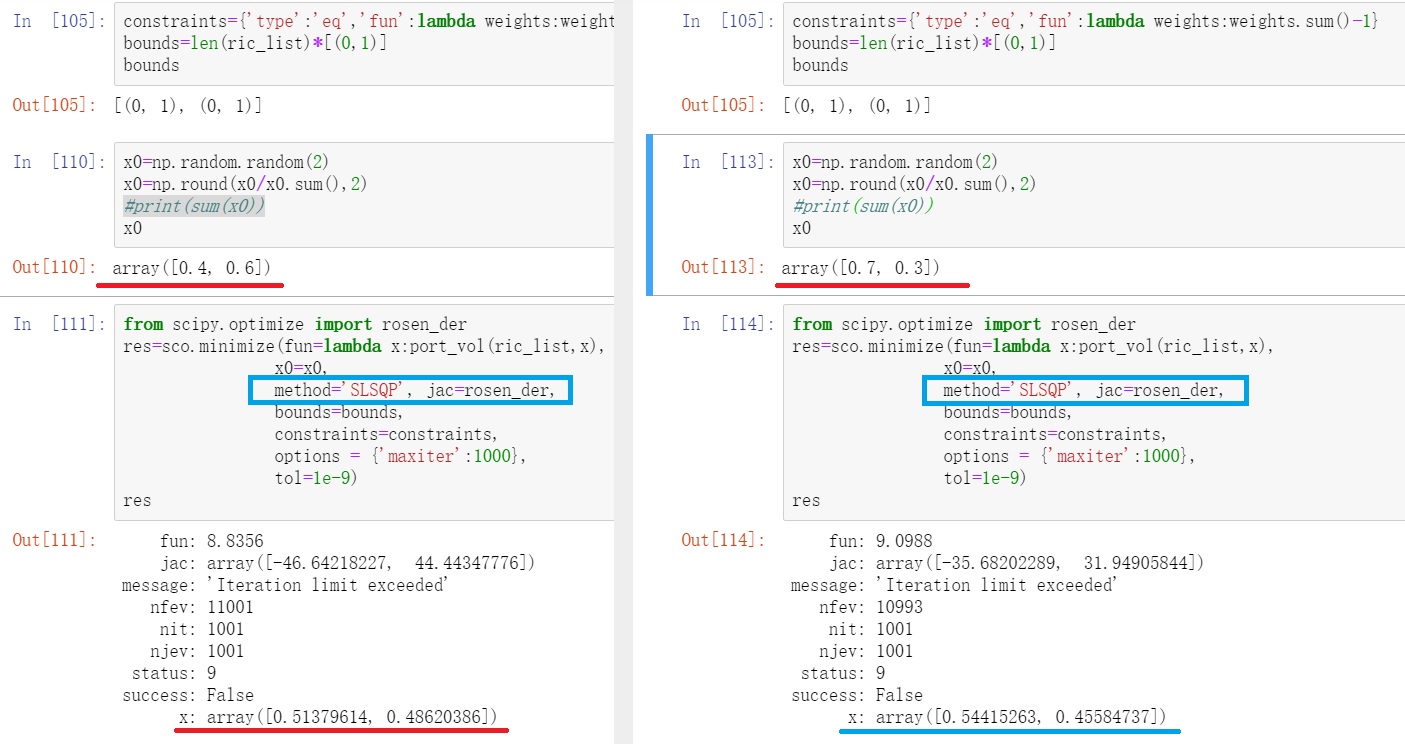

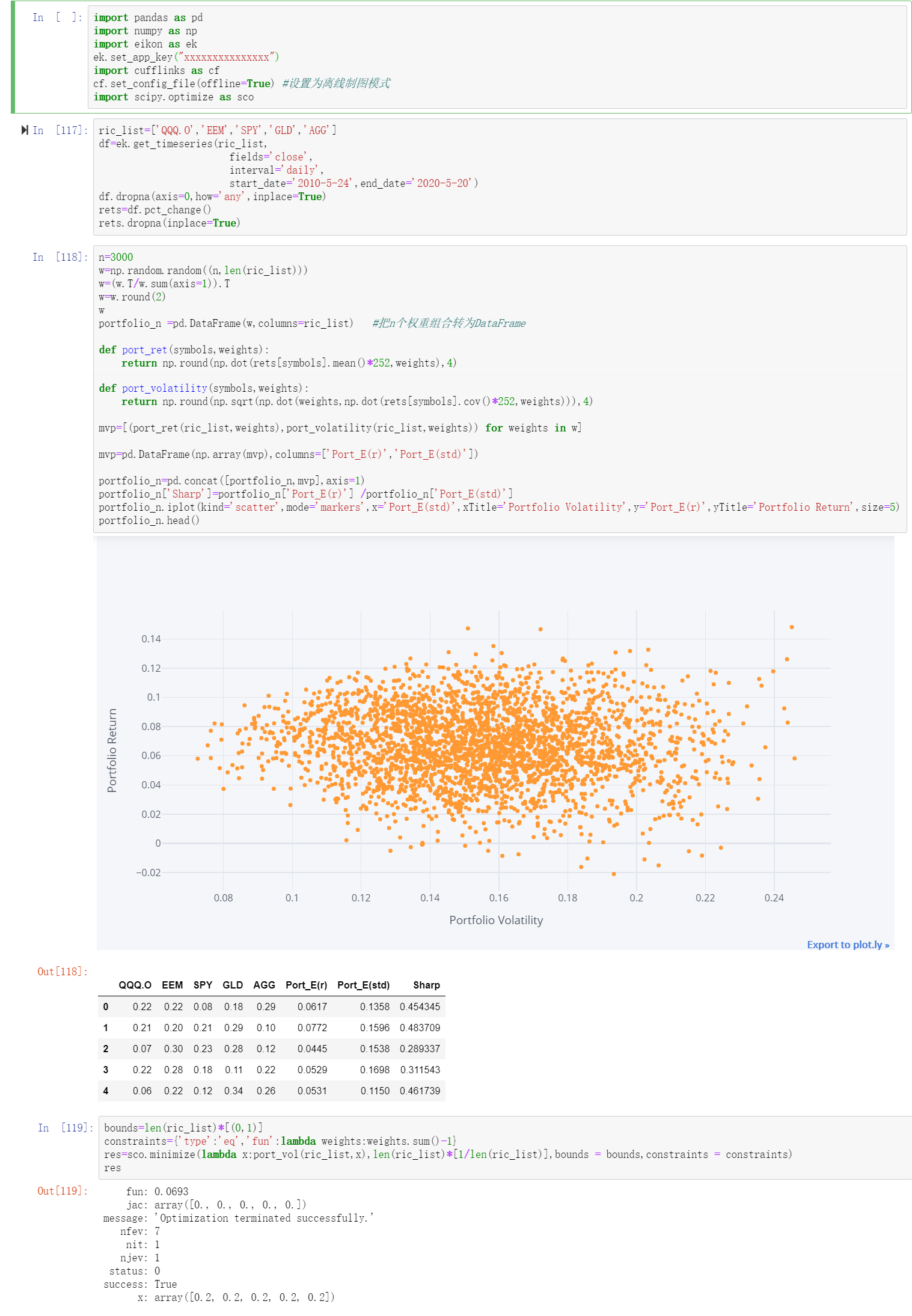

When testing the code in video tutorial "Eikon Data API - Python Quants Tutorial 6 - Portfolio Theory", I found it's hard to have minimized volatility by the sample code demonstrated in the video.

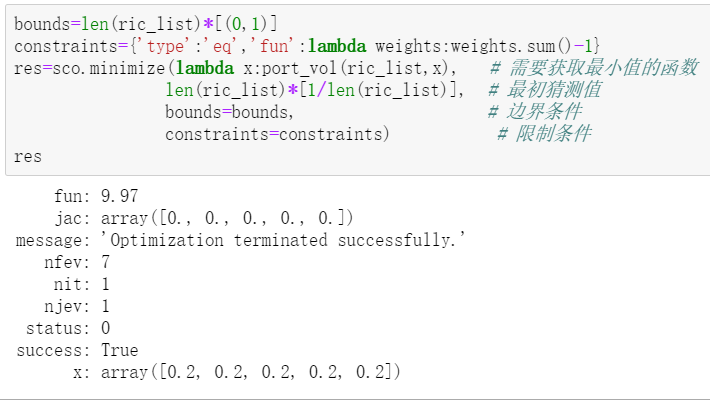

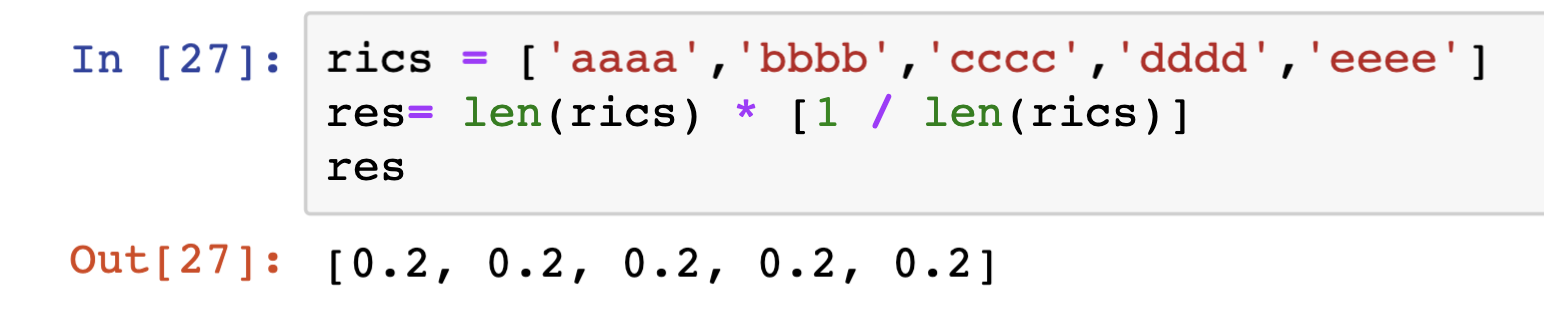

The average weight as initial guess will always be the optimization result. If a portfolio consists 5 stocks, the optimized weighting would be [0.2,0.2,0.2,0.2,0.2]. Is there anything missed by me or in the video?

Also pasted with version of each package below:

Also pasted with version of each package below: