I am looking to create a projected cashflow based on upcoming dividends over next 12 months. I tried

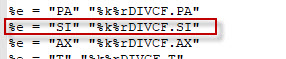

ek.get_data(riclist, fields=['TR.DivAdjustedNet','TR.DivPayDate', 'TR.DividendFrequency', 'TR.DivType'], parameters = {'SDate':START, 'EDate':'12M', 'Curn' : CURRCODE, 'CH':'Fd', 'RH':'IN'})

This gave me a look forward till August - but I'm not getting a twelve month view. I wrote to the Helpdesk, who gave me a very helpful excel sheet which had a VBA code to pull the future cashflows. I asked for the Excel formula so I could code it in python, but got the following response

We do not have a direct datatype to get this data but we can use an excel function. Please the attached excel file where the codes are shown.

Also, if you want the VBA function to code this, we have our developers website where you can log your request and they will respond to you directly.

Please refer to the link: https://developers.refinitiv.com/home

Any help on how we can do this in python using the Eikon API? I have tried the responses in related links but haven't got anywhere!