I'm looking to get Volatility and Volume information form the Eikon python API, both real time and historical. I'm having some issues, so first I'll explain what I can do, and then ask the questions:

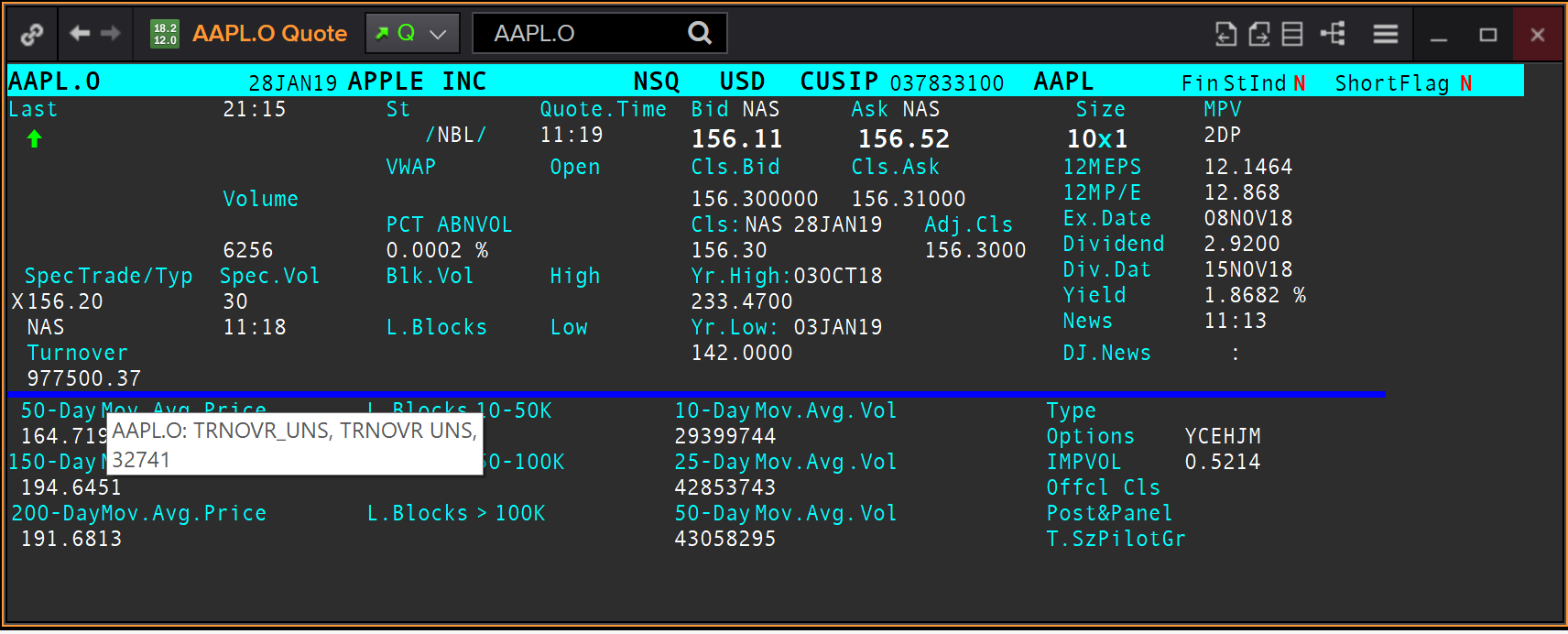

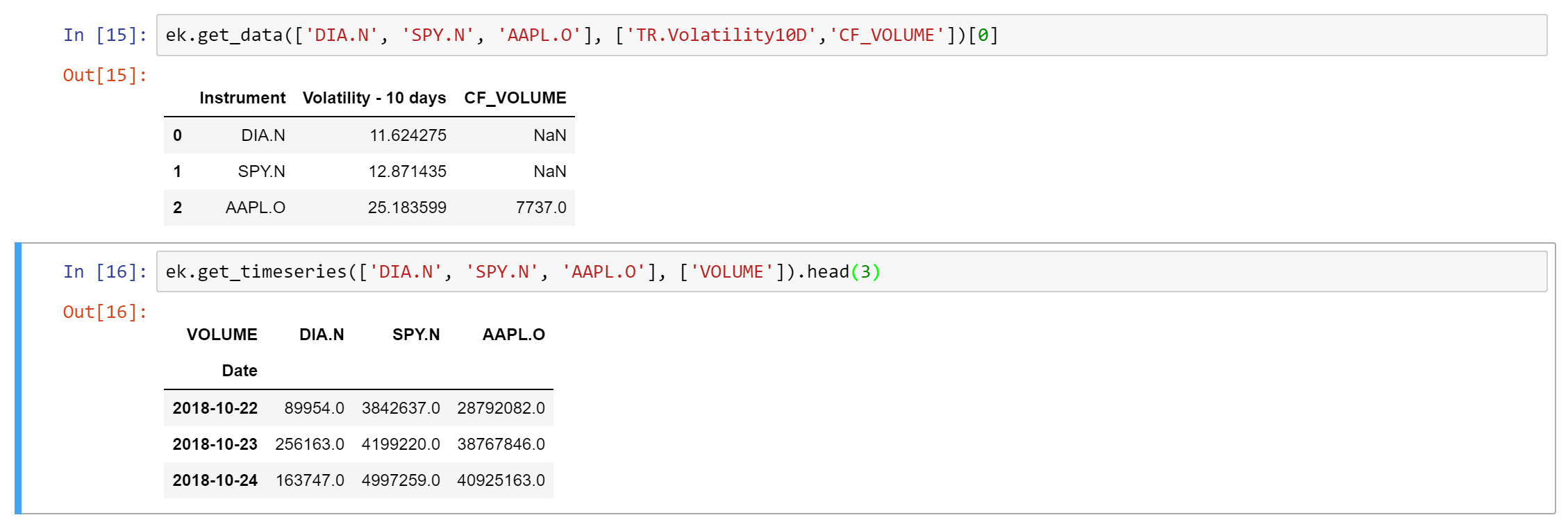

I've been able to get real-time access to volume and volatility information using the ek.get_data function, and using the following variables:

"TR.Volatility10D", "TR.VOLUME", "CF_VOLUME",

But not with "VOLUME" which does not return data.

When looking for the same information from the past using ek.get_timeseries, I couldn't not find any data using "TR.Volatility10D", "TR.VOLUME" or "CF_VOLUME",

But mysteriously "VOLUME" works to return historical data.

Below is one query I was testing:

prices = ek.get_timeseries(['DIA.N', 'SPY.N'], fields=["TR.Volatility10D", "VOLUME", "TR.VOLUME", "Close"], start_date = "2019-01-18", end_date = "2019-01-25", interval="hour")

Now my questions:

- Variable names that work with get_timeseries are different than those that work with get_data - where is this inconsistency documented?

- How can I get historical Volatility information using ek.get_timeseries?

Thanks for the help!

-- Jonathan