I want to get USA Fund NetValue using python, can anybody tell me how to do this? Thank you

- Home

- Anonymous

- Sign in

- Create

- Post an idea

- Create an article

- Spaces

- Alpha

- App Studio

- Block Chain

- Bot Platform

- Connected Risk APIs

- DSS

- Data Fusion

- Data Model Discovery

- Datastream

- Eikon COM

- Eikon Data APIs

- Electronic Trading

- Elektron

- Intelligent Tagging

- Legal One

- Messenger Bot

- Messenger Side by Side

- ONESOURCE

- Open Calais

- Open PermID

- Org ID

- PAM

- ProView

- ProView Internal

- Product Insight

- Project Tracking

- RDMS

- Refinitiv Data Platform

- Rose's Space

- Screening

- Side by Side Integration API

- TR Knowledge Graph

- TREP APIs

- TREP Infrastructure

- TRKD

- TRTH

- Thomson One Smart

- Transactions

- Velocity Analytics

- Wealth Management Web Services

- Workspace SDK

- World-Check Data File

- 中文论坛

- Explore

- Tags

- Questions

- Ideas

- Articles

- Users

- Badges

For a deeper look into our Eikon Data API, look into:

Overview | Quickstart | Documentation | Downloads | Tutorials | Articles

question

How to get USA Fund NetValue data using PYTHON interface

1 Answer

I suggest you speak to your local Thomson Reuters Support Desk and build out an excel model with their help first - this will get you familiarised with the data model. Alternatively, you can pick a sample instrument and open it in the Data Item Browser app (DIB) on Eikon to find the proper field.

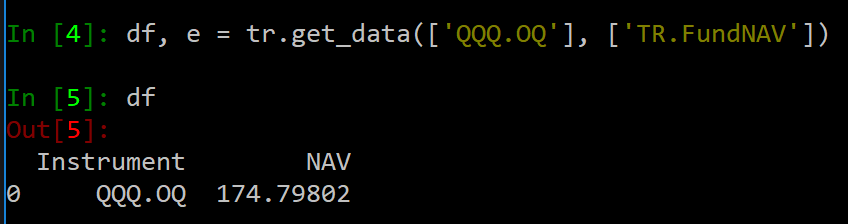

Here is a quick sample for an US ETF:

df, e = tr.get_data(['QQQ.OQ'], ['TR.FundNAV'])

Many thanks. I used PyCharm to develop my python programme. Which library should I include first? For example, when we use pandas ,we often used like the following:

# -*- coding: utf-8 -*-from datetime import *

from pandas import DataFrame,Series

import pandas as pd

import os

import logging

import math

You should install the eikon package with pip and import it. Have a look at this tutorial to set up the dev environment.

Also another question, I see your code,I should input the Fund Code to get its netvalue. then,how can I get the full fundcode of USA fund market?

@qidifei

I suggest you also see the following tutorial, which talks at length about metadata discovery (how you can find symbols, fields and parameters to use in your data requests) and about modeling data retrieval in Excel and translating it into Python code.

https://developers.refinitiv.com/en/api-catalog/eikon/eikon-data-api/tutorials#fundamentals-api-company-tearsheet-estimate

As I proposed originally, I suggest you discuss this with your local support desk and build out your workflow with excel.