outdated.

outdated.

For a deeper look into our Eikon Data API, look into:

Overview | Quickstart | Documentation | Downloads | Tutorials | Articles

outdated.

outdated.

Hi @XxFaTexX

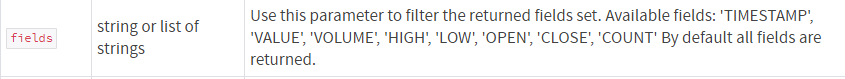

The get_timeseries() call will only provide a set number of fields as outlined within the documentation:

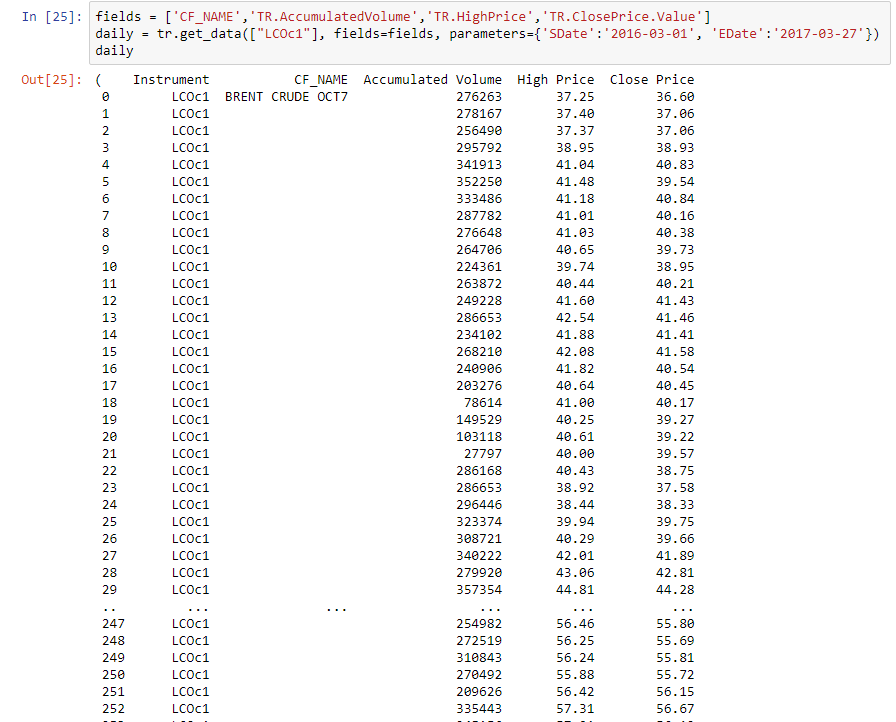

If you wish to retrieve other specific fields, you can use the get_data() which offers the ability to specify a start and end date. I would use the Data Item Browser to investigate which fields you are interested in for your instruments of interest. For example:

outdated.

outdated.

Try

ek.get_data(['Oc1'],['TR.SETTLEMENTPRICE.date', 'TR.SETTLEMENTPRICE'],{'SDate':'2016-03-01', 'EDate':'2017-07-28'})

If you were using Formula Builder wizard in Eikon Excel to discover field names, check out Parameters & Quick Functions tab on the right hand side of the wizard dialog box after you've selected the field. In this tab you will find parameters applicable to the field you've chosen as well as output options. The latter is how you can discover TR.SETTLEMENTPRICE.date to get the dates.

Thanks Alex for your reply. Took me some time switching around as the API proxy forces the user to be logged out from Excel and vice versa which can be quite a trouble.

Building on this, I realize there are some parameters I can't seem to draw using this method.

For example, in TR, I can draw via timeseries for example LCOc1:

- NDA_RAW.Nda_market_volume

- NDA_RAW.Nda_floor_volume

- NDA_RAW.Nda_on_floor_volume

- NDA_RAW.Nda_market_open_interest

I looked through the parameters for get_data method and can't seem to find a solution to this.

Appreciate any advice.

Thank you!

outdated.

outdated.

I'm afraid there's no way currently to retrieve this data using Eikon Python API.

Here's the link to a similar question asked on this forum previously.

https://community.developers.refinitiv.com/questions/16910/how-do-i-download-historical-data-from-starmine.html

outdated.

outdated.

Thank you for reporting this issue. It appears to be a bug in get_data method incorrectly handling the case when SDate<EDate and SDate falls on a market holiday. The entire timeseries in the result set are shifted and the dates and values are mismatched by one day. I have escalated the issue to the development. In the meantime the only workaround I can suggest is to either ensure that SDate is a business day or to retrieve timeseries in reverse chronological order by swapping SDate and EDate values. In other words make sure that SDate>EDate.

And here is another example (implemented in R), where dates must be coming out wrong:

fieldify<-function(x){

return(as.list(paste0(x,c("(SDate=19890101,EDate=0,Curn=NOK,Frq=D).date","(SDate=19890101,EDate=0,Curn=NOK,Frq=D)"))))}

data_frame1<- data.table(get_data(list("B0VKMC4"), fieldify('TR.PriceClose'),debug=F))

data_frame2<- data.table(get_data(list("B0VKMC4"), fieldify('TR.ASKPRICE'),debug=F))

I assume that the TR.PriceClose works correctly, while TR.ASKPRICE does not:

> data_frame1

Instrument Date Price Close

1: B0VKMC4 2005-12-27T00:00:00Z 41.3636146430895

2: B0VKMC4 2005-12-28T00:00:00Z 41.2274194311675

3: B0VKMC4 2005-12-29T00:00:00Z 41.4107644028658

4: B0VKMC4 2005-12-30T00:00:00Z 41.4387631868717

5: B0VKMC4 2006-01-02T00:00:00Z 41.2204024211472

---

3030: B0VKMC4 2017-08-07T00:00:00Z 56.6653645219114

3031: B0VKMC4 2017-08-08T00:00:00Z 56.7369633667787

3032: B0VKMC4 2017-08-09T00:00:00Z 56.9109469055681

3033: B0VKMC4 2017-08-10T00:00:00Z 57.1856936041995

3034: B0VKMC4 2017-08-11T00:00:00Z 57.0047611167585

> data_frame2

Instrument Date Ask Price

1: B0VKMC4 1989-01-02T00:00:00Z 49.516359760791

2: B0VKMC4 1989-01-03T00:00:00Z 41.5984501355687

3: B0VKMC4 1989-01-04T00:00:00Z 41.3001324064879

4: B0VKMC4 1989-01-05T00:00:00Z 41.2162677012143

5: B0VKMC4 1989-01-06T00:00:00Z 40.573643486065

---

7064: B0VKMC4 2017-08-07T00:00:00Z

7065: B0VKMC4 2017-08-08T00:00:00Z

7066: B0VKMC4 2017-08-09T00:00:00Z

7067: B0VKMC4 2017-08-10T00:00:00Z

7068: B0VKMC4 2017-08-11T00:00:00Z

There's a couple of issues here. One is the bug that was acknowledged in my comments to the original question. You can find a workaround I suggest in the same comment. The other issue is data. There are lots of missing data points in both close price and ask price series. More in the ask series than in the close. E.g. there is no ask price since Feb this year until now. This may or may not be correct. It's not unusual to have a day without a price for thinly traded instruments such as this fund. Though I'm not an expert in how this fund is traded or priced.

The best way to deal with data issues is to reproduce them using Eikon Excel and report to Thomson Reuters Helpdesk.

outdated.

outdated.

Please see the overview page for the API on this Developer Portal.

https://developers.refinitiv.com/en/eikon-web-and-scripting-apis

The API is titled "Eikon Web and Scripting APIs Beta". It is a wide open Beta, which you're welcome to join. But we're not yet offering production support for this API. If you expect production quality, please consider using mature APIs (COM or .NET).

Ah I see. Okay thanks.

Seems like TR is moving a lot slower than BB in this regard.

I think it is best not to get too hot under the collar from either end. This product is very promising, while "mature" APIs are of limited usability.

The best way forward is to try and see what is causing issues with get_data output. And in particular, date-data alignment. And how to diagnose it.

Alex, do you have some suggestions?